child care tax credit portal

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Costs in nearly every sector are rising.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

. Connecticut State Department of Revenue Services. Child care costs rise. Box 729 Trenton NJ 08625-0729 Phone.

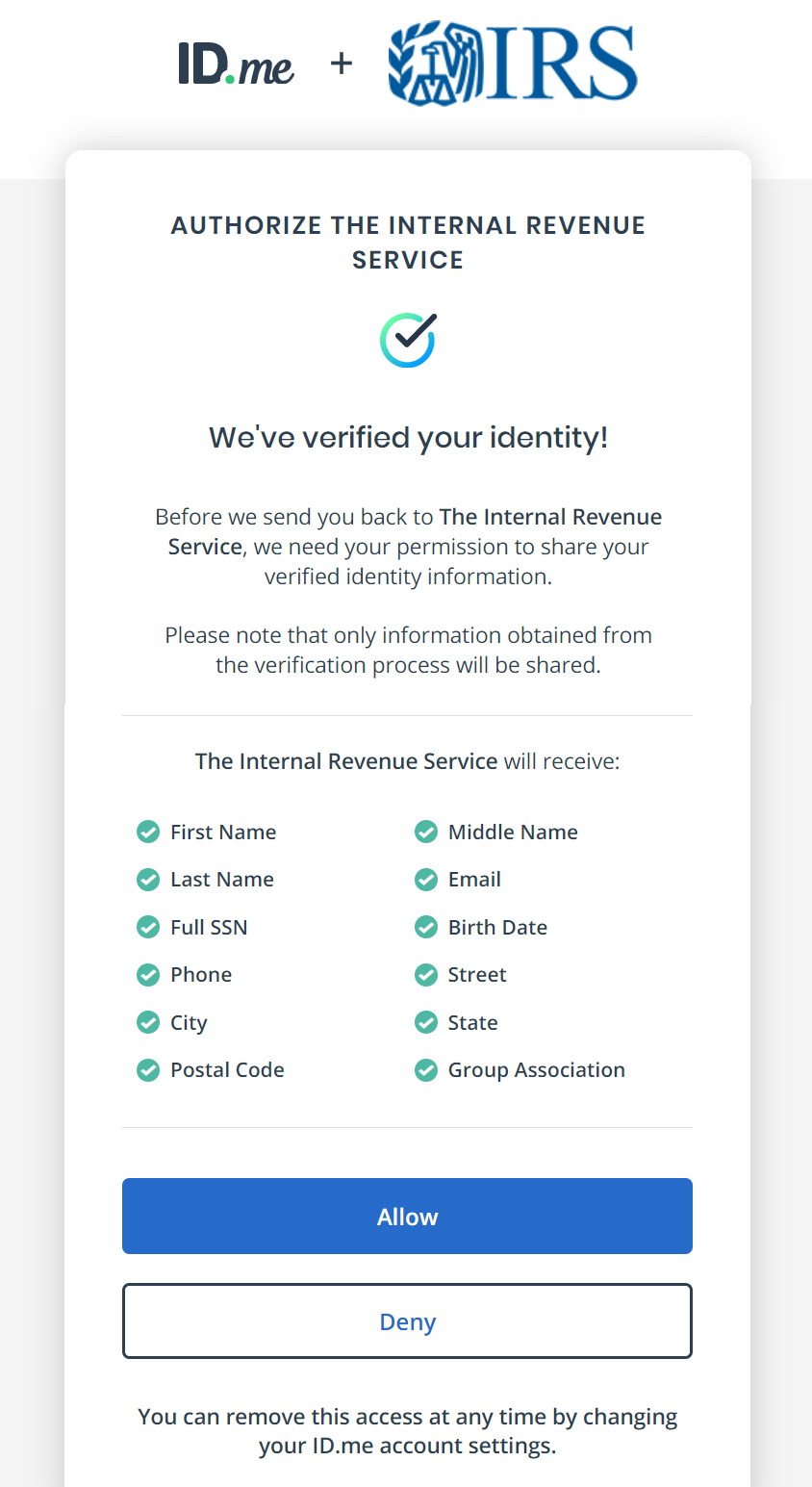

Ad Free tax filing for simple and complex returns. Guaranteed maximum tax refund. Access Child Tax Credit Update portal.

Community Child Care Solutions Inc. What is the Child Tax Credit. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

Figure represents the average of costs for annual care of an infant and a 4-year-old. Tax Credits Phone Number. The Child Tax Credit will help all families succeed.

The Employer-Provided Child Care Facilities and Services credit allows businesses to receive a valuable tax credit of 25 of related child care expenses and 10 of their resource and referral. Free means free and IRS e-file is included. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file.

Department of Revenue Services. View data from most recent tax returns and access additional records. Max refund is guaranteed and 100 accurate.

Department of Children and Families PO. In 2021 almost every family will be eligible for an additional Child Tax Credit to help families recover from the pandemic and support our youngest Texans. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going. 103 Center Street Perth Amboy NJ 08861 732 324-4357 Fax 732 376-0271 website. Find Tax Credits Location Phone Number and Service Offerings.

Have been a US. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. 45 Knightsbridge Rd Ste 22 Piscataway NJ 08854 Service.

IMPORTANT INFORMATION - the following tax types are now available in myconneCT. In urban areas the cost is for care at a child care center and for home care in rural areas.

Child Tax Credit Everything You Need To Know Before The July 15 Rollout Gobankingrates

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

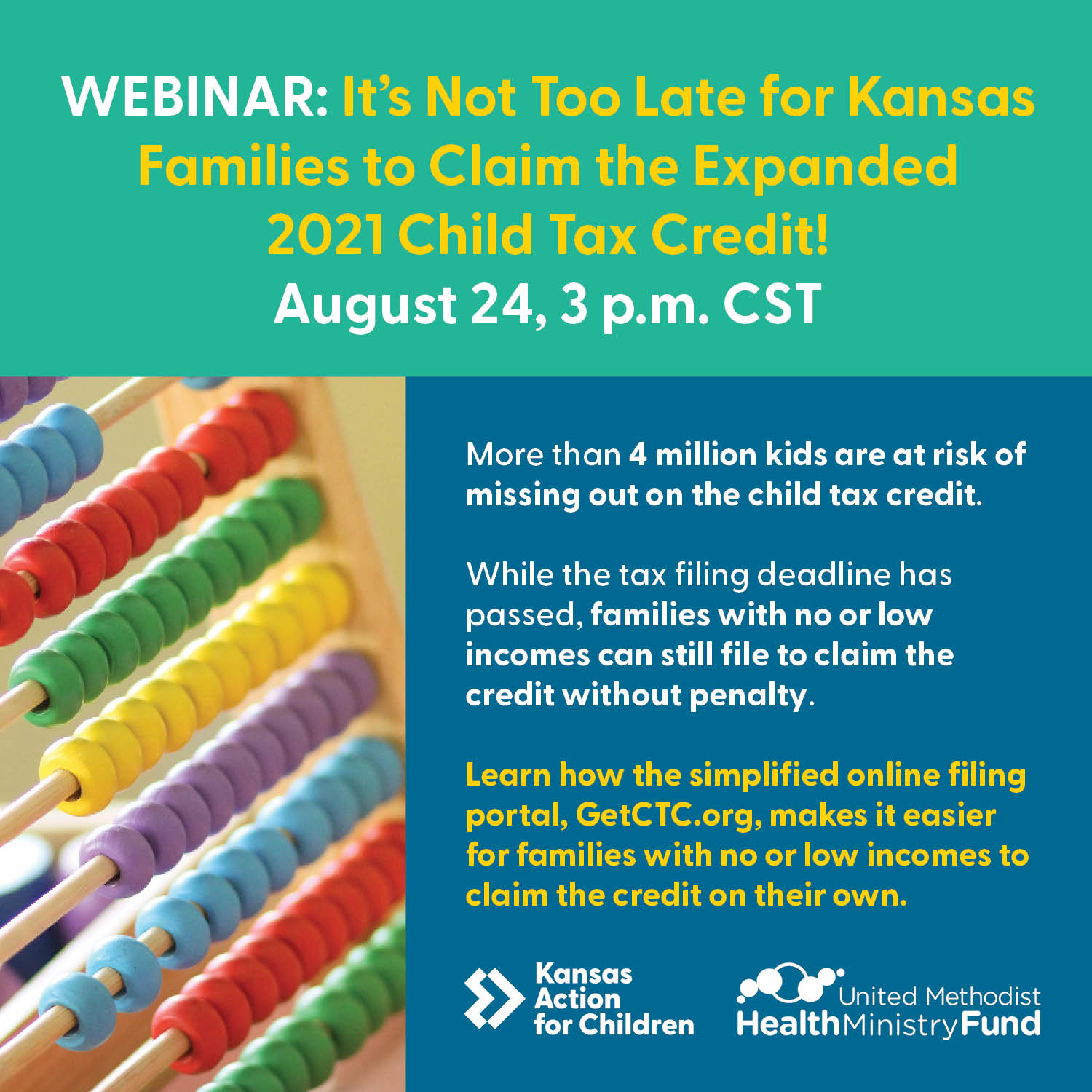

United Methodist Health Ministry Fund On Twitter While The Tax Filing Deadline Has Passed Families With No Or Low Incomes Can Still File To Claim The 2021 Child Tax Credit Learn How

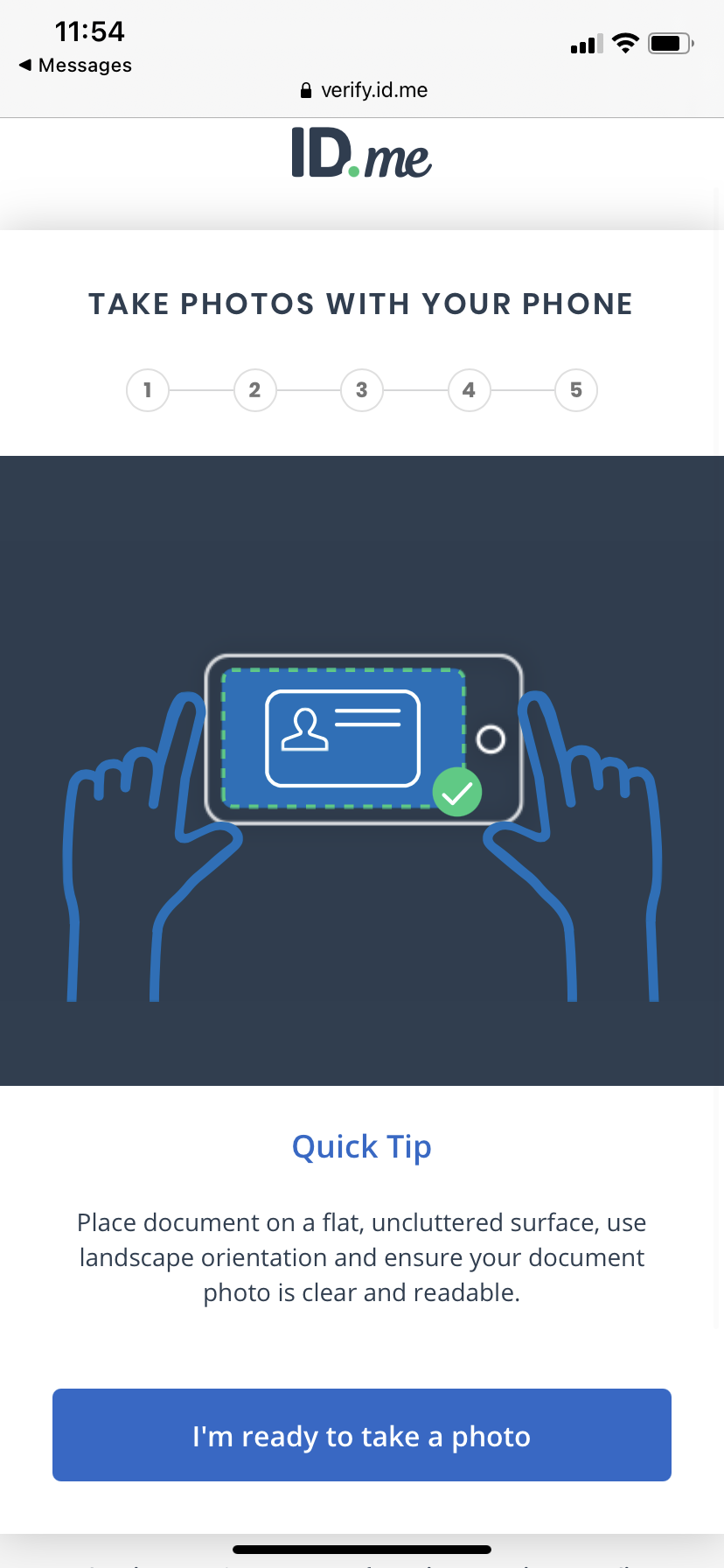

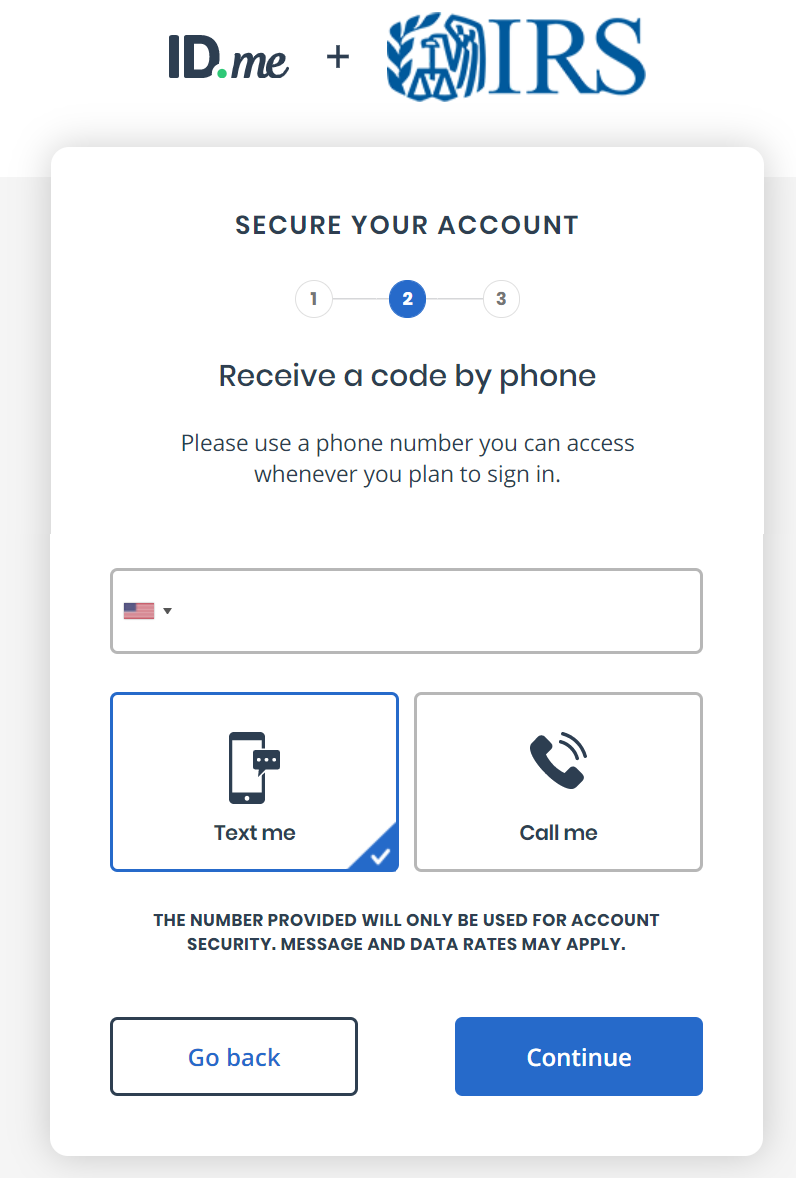

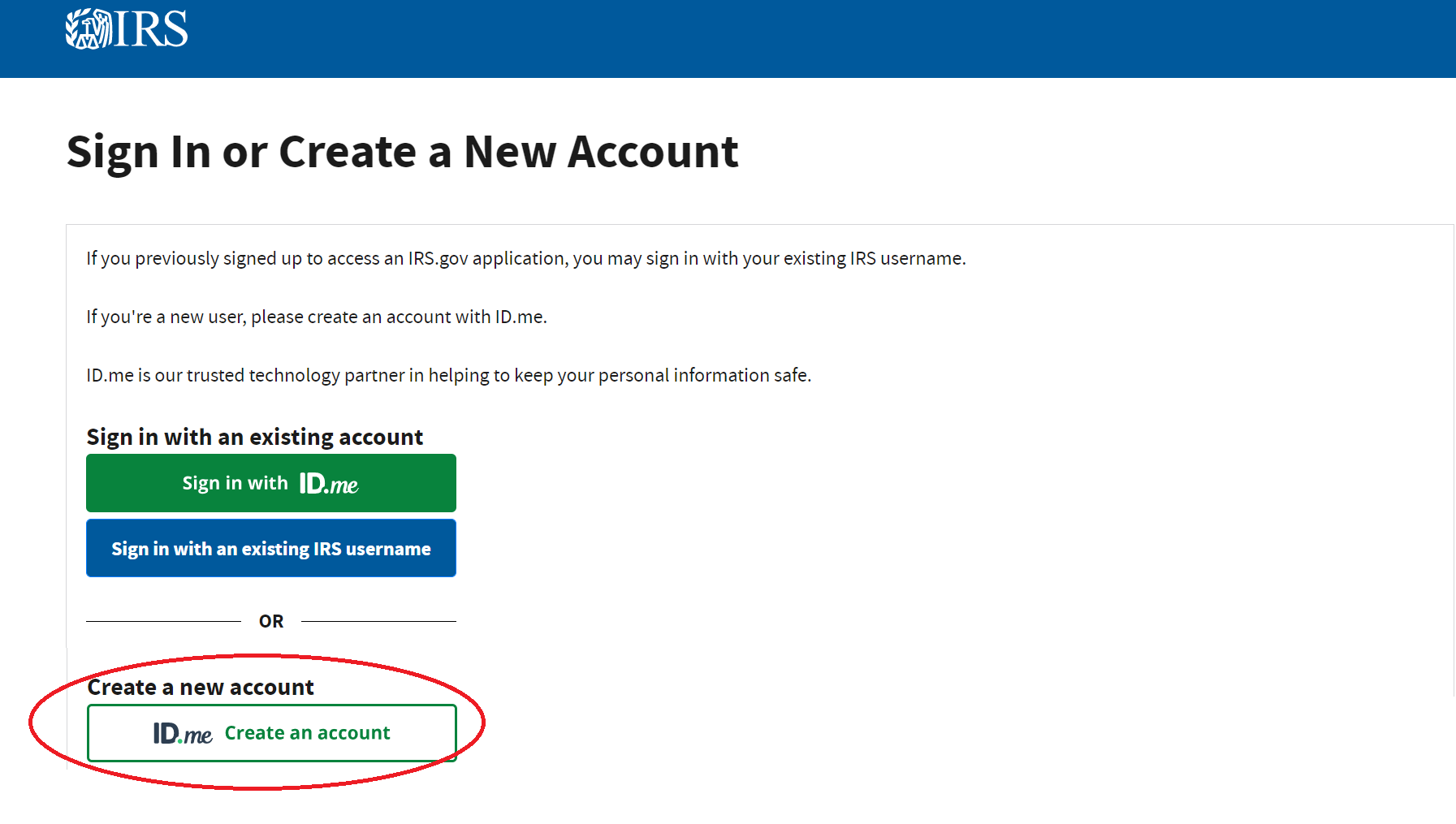

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Update Irs Launches Two Online Portals

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Feds Relaunch Simplified Online Portal For Low Income Families To Claim Expanded Child Tax Credit Conduit Street

What To Do If The Irs Child Tax Credit Portal Isn T Working Gobankingrates

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

:quality(70)/d1hfln2sfez66z.cloudfront.net/04-21-2021/t_c936fdfa93e84f01a8504fa386d17fe4_name_Child_tax_credit___What_you_need_to_know_Poster.jpg?_a=ATO2BAA0)